nebraska sales tax rate 2020

Nebraska provides no tax breaks for Social Security benefits and military pensions while real estate is assessed at 100 market value. Find your Nebraska combined state and local tax rate.

Midwest State Income And Sales Tax Rates Iowans For Tax Relief

550 Is this data incorrect Download all Nebraska sales tax rates by zip code.

. Waste Reduction and Recycling Fee. The Nebraska State Sales Tax is collected by the merchant on all qualifying sales made within Nebraska State. Ord collects a 15 local sales tax the maximum local.

Maximum Local Sales Tax. Additionally city and county governments can impose local sales and use tax rates of up to 2 percent. Nebraska State Sales Tax.

With local taxes the total sales tax rate is between 5500 and 8000. Ad Manage sales tax calculations and exemption compliance without leaving your ERP. The Nebraska sales tax rate is currently.

Simplify Nebraska sales tax compliance. What is the sales tax rate in Omaha Nebraska. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021.

Municipal governments in Nebraska are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 0825 for a total of 6325 when combined with the state sales tax. Nebraska has a statewide sales tax rate of 55 which has been in place since 1967. The County sales tax rate is.

Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The Nebraska state sales and use tax rate is 55 055.

The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate. The Ord Sales Tax is collected by the merchant on all qualifying sales made within Ord. The minimum combined 2022 sales tax rate for Omaha Nebraska is.

The Nebraska sales tax rate is currently. Average Local State Sales Tax. The Omaha sales tax rate is.

Average Sales Tax With Local. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2022. FilePay Your Return.

Exemptions to the Nebraska sales tax will vary by state. The Nebraska state sales and use tax rate is 55 055. Tax Rate Starting Price.

Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. The base state sales tax rate in Nebraska is 55. The state sales tax rate in Nebraska is 5500.

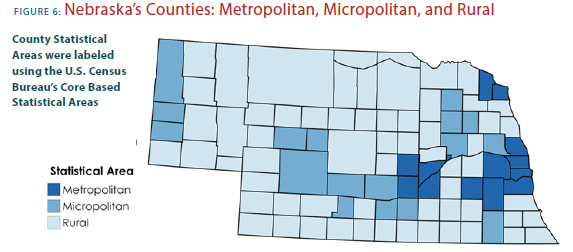

There are a total of 334 local tax jurisdictions across the. Nebraska sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

Avalara provides supported pre-built integration. Nebraska has a state sales tax of 55 percent for retail sales. Wayfair Inc affect Nebraska.

The minimum combined 2022 sales tax rate for Nemaha Nebraska is. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825 on top of the state tax. 536 rows Nebraska Sales Tax55.

While many other states allow counties and other localities to collect a local option sales tax Nebraska does not permit local sales taxes to be collected. Groceries are exempt from the Ord and Nebraska state sales taxes. The Nebraska NE state sales tax rate is currently 55.

Nebraska has recent rate changes Thu Jul 01 2021. Raised from 55 to 65. Nebraska Department of Revenue.

This is the total of state county and city sales tax rates. 800-742-7474 NE and IA. While many other states allow counties and other localities to collect a local option sales tax Nebraska does not permit local sales taxes to be collected.

We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process. 800-742-7474 NE and IA. The Nebraska sales tax rate is 55 as of 2022 with some cities and counties adding a local sales tax on top of the NE state sales tax.

The Gretna Nebraska sales tax is 550 the same as the Nebraska state sales tax. The Ord Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Ord local sales taxesThe local sales tax consists of a 150 city sales tax. Sales Tax Rate Finder.

Did South Dakota v. Nebraska sales tax details. Sales and Use Taxes.

Integrate Vertex seamlessly to the systems you already use. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. Download Or Email Form 6 More Fillable Forms Register and Subscribe Now.

This is the total of state county and city sales tax rates. Maximum Possible Sales Tax. The Nebraska State Nebraska sales tax is 550 the same as the Nebraska state sales tax.

30 rows Nebraska NE Sales Tax Rates by City. Nebraska also has special taxes for certain industries that may be on top of. Nebraska Department of Revenue.

Wilcox Hildreth Bloomington Riverton Naponee and Upland. This is the total of state county and city sales tax rates.

Tax Foundation Proposed Tax Rate Increases Undo Impact Of Property Tax Cuts

This Time It S Personal Nebraska S Personal Property Tax

2020 Nebraska Property Tax Issues Agricultural Economics

Wfr Nebraska State Fixes 2022 Resourcing Edge

Nebraska Income Tax Brackets 2020

Nebraska State Tax Refund Tax Brackets State Deductions

Don T Die In Nebraska How The County Inheritance Tax Works

Compared To Rivals Nebraska Takes More From Taxpayers

General Fund Receipts Nebraska Department Of Revenue

Sales Tax On Grocery Items Taxjar

State Corporate Income Tax Rates And Brackets Tax Foundation

General Fund Receipts Nebraska Department Of Revenue

Iowa Sales Tax Small Business Guide Truic

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Get Your 2021 2022 Nebraska State Income Tax Return Done

Get The Facts About Nebraska S High Tax Burden